Insurance for Architects

AREAS OF LIABILITY FOR ARCHITECTS

The nature of architectural work (high-value, high-visibility, and highly collaborative) means that even the most careful professionals can find themselves facing significant legal and financial threats. Architects face a wide range of professional risks that go far beyond design flaws, so whether you’re working solo or managing a full-service architecture firm, your services and responsibilities inherently expose you to liability from many sources:

Design Flaws or Omissions

Miscalculations or errors in construction documents can delay projects and trigger costly lawsuits.

Contractual Obligations

Failing to meet client expectations or project specs can lead to breach-of-contract claims.

Project Delays

Even minor delays caused by design revisions or miscommunication can turn into major financial losses.

Site Visits & Field Coordination

Injuries or property damage during site inspections can create legal exposure.

Regulatory Compliance

Mistakes related to building codes, zoning, or permits can lead to fines or litigation.

Third-Party Claims

You could be named in a lawsuit even if the issue was caused by another firm or contractor on the project.

The Challenge of Finding the Right

Insurance for ArchitectURE FIRMS

Many insurance providers lump architects into generic commercial categories, treating your firm like any other small business. But the truth is, the risks architects face are anything but typical. Generic policies often:

- Overlook key professional exposures

- Offer irrelevant coverage that inflates premiums

- Exclude protection for claims tied to design work

And when a claim occurs, these providers often lack the industry-specific understanding needed to navigate architecture-related liability.

That’s why we built Strux Insurance: to offer cost-effective, industry-specific protection designed to get our customers the right coverage, so they can keep doing what they do best.

How Strux Is Different

Strux Insurance was founded by engineering and construction professionals who understand the industry and the risks. We’re not just brokers. We’re industry professionals who have practical experience in the construction industry and need the same kind of insurance solutions that you do. Here’s what sets us apart:

Niche Expertise

We work exclusively with firms in the architecture, engineering, and construction space.

Specialized Carriers

We’ve built relationships with top-tier insurance providers who specialize in coverage for design professionals.

Exclusive Pricing

Our partner carriers give us access to preferred rates and specialized policy options you won’t find elsewhere.

Licensed Nationwide

We’re licensed in over 45 states, so no matter where your firm operates, we can help.

How to Determine Which Insurance Plan

Is Right for Your Business

Choosing the right insurance plan starts with understanding the fundamentals of coverage:

what it protects, how much protection you need, and what it will cost.

1. What Does It Cover?

Start by identifying your firm’s specific exposures:

- Does your work involve high-risk structures or specialty designs?

- Do you handle permitting, code compliance, or client-facing documentation?

- Do you have employees or subcontractors who visit active job sites?

The right plan should protect you against both physical risks (covered by general liability) and professional risks (covered by E&O insurance). Professional liability insurance E&O —often called errors and omissions (E&O)—steps in when a client claims your professional services caused them a financial loss. Even the most experienced architects can face lawsuits if a client believes a design oversight, missed code requirement, or project delay has led to unexpected costs.

This coverage is essential because mistakes happen, and when they do, clients may seek compensation for errors, omissions, or perceived negligence in your work. E&O insurance helps cover the legal costs, settlements, or judgments that might arise, ensuring your firm isn’t financially derailed by a single claim.

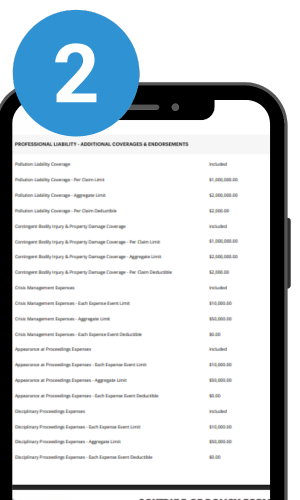

2. How Much Coverage Do You Need?

Coverage limits depend on the size and complexity of your projects:

- Small firms may need $500k–$1M in coverage

- Mid-size firms often need $1M–$3M

- High-value projects may justify limits of $5M or more

Look for policies that scale with your growth and allow for flexible endorsements.

3. What Will It Cost?

Insurance premiums are based on multiple factors:

- Revenue and project volume

- Claims history

- Project types (residential vs. commercial)

- Geographic location

- Desired limits and deductibles

Other important considerations include your years in business, the number of employees you have, and the unique needs of your firm. For example, a long-standing firm with a spotless claims history may pay less than a new business or one with prior incidents. Location matters, too—urban, high-risk, or high-value markets may see higher premiums.

Professional liability insurance E&O costs for architects can range widely, typically from $300 to $4,000 per year, depending on these variables. The best way to determine your actual cost is to get a tailored quote based on your firm’s specific profile.

At Strux, we analyze these variables and match your firm with carriers that understand your risk profile, so that you get the best coverage for the lowest cost.

4. How Easy Is It to Update or File a Claim?

Consider how responsive your provider is and whether they understand the work you do, so that when you need them, they will be able to act quickly and get you the support you need.

5. What Does Professional Liability Insurance E&O For Architects Actually Cover?

Professional liability insurance for architects E&O (sometimes called Errors & Omissions or E&O insurance) is designed to cover claims that arise directly from your professional services. This typically includes:

- Negligence: Allegations that your design or advice did not meet professional standards and caused a client financial loss or property damage.

- Inaccurate Advice: Claims that errors in your recommendations led to costly mistakes.

- Misrepresentation: Cases where a client believes they were misled by your documentation or communication.

If you’re sued due to your professional work, this insurance can help cover:

- Legal costs and defense fees, even if the claim is groundless

- Judgments and settlements if you’re found liable

- Associated court costs

By ensuring your plan addresses these exposures—alongside your firm’s unique activities—you can safeguard your business against the most common (and costly) risks architects face.

6. What Does Commercial Property Insurance Cover for Architects?

Commercial property insurance is designed to protect the physical assets your firm relies on every day. For architecture practices, this means coverage extends to your office space—whether you own or lease—as well as the valuable equipment and tools essential to your work.

Typical items covered include:

- Desks, drafting tables, and ergonomic workstations

- Computers, design software hardware, and tablets

- Industry-specific tools like architectural scales, triangles, and measuring devices

- Printers, scanners, and plotters

- Office furnishings and supplies

If your premises are damaged by fire, theft, or certain natural disasters, commercial property insurance helps cover the costs to repair or replace both your space and your essential equipment—keeping your business on track no matter what comes your way.

Cyber insurance (sometimes called data breach coverage) is designed to help when the unthinkable happens. Here’s how it can protect your practice:

- Covers legal costs and expenses if sensitive client, employee, or project data is exposed or stolen

- Pays for required client notifications following a breach

- Funds credit monitoring services for clients or employees affected by the incident

- Helps manage your reputation by supporting PR efforts after an event

- Provides access to cyber specialists who can guide the technical, legal, and communications response

Whether your firm is two people or twenty, data breaches and cyber threats are real. Including this coverage ensures your business isn’t left footing the bill when digital risks become reality.

7. Workers’ Compensation—Essential Protection for Your Team

Workers’ Compensation—Essential Protection for Your Team

If you have employees (or even regular subcontractors), workers’ compensation insurance is a must-have for architecture firms. This coverage steps in when a team member suffers a work-related injury or illness—whether it’s a back strain during a site visit or an accident in the office.

Workers’ comp typically helps pay for:

- Medical expenses tied to workplace injuries or illnesses

- Lost wages while your employee recovers and can’t work

- Rehabilitation or ongoing care, such as physical therapy

Not only does this safeguard your team and help them get back on their feet, but it also protects your business from major out-of-pocket costs and potential lawsuits related to workplace injuries. In most states, it’s a legal requirement if you have staff—so make sure your policy meets all state-specific mandates.

8. Do Architects Need to Worry About Data Breach or Cyber Insurance?

In today’s digital landscape, even architecture firms need to think beyond bricks and mortar. Sensitive client data, proprietary project files, and confidential communications all live on your servers—and that means you could face serious challenges if your systems are ever compromised.

Cyber insurance (sometimes called data breach coverage) is designed to help when the unthinkable happens. Here’s how it can protect your practice:

- Covers legal costs and expenses if sensitive client, employee, or project data is exposed or stolen

- Pays for required client notifications following a breach

- Funds credit monitoring services for clients or employees affected by the incident

- Helps manage your reputation by supporting PR efforts after an event

- Provides access to cyber specialists who can guide the technical, legal, and communications response

Whether your firm is two people or twenty, data breaches and cyber threats are real. Including this coverage ensures your business isn’t left footing the bill when digital risks become reality.

Get the Right Coverage for Your Practice

Architects face enough pressure in their everyday work. You shouldn’t have to worry about whether your insurance will hold up if something goes wrong.

Strux Insurance helps architects across the U.S. get the coverage they need to keep doing what they do best.

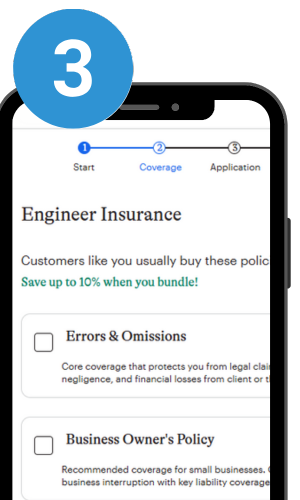

Answer Some Questions About Your Business and Projects

Get An Instant Quote Tailored To Your Business

Choose The Best Plan and Sign Up Online

Prefer a call?

If you’d like a custom quote from one of our agents, reach out to us at

945-293-3922.

Prefer a call? If you’d like a custom quote from one of our agents, reach out to us at 945-293-3922.

The Strux Insurance Team

Our company was founded by engineering and construction veterans, who understand the challenges of getting the right coverage and built solutions to serve the engineering, architecture and construction communities. We’re more than an insurance provider—we’re industry veterans who understand the real risks behind every drawing and project. We created Strux to fill the gap between generic insurance offerings and the specialized needs of architects, engineers, builders, and general contractors. Our mission is to deliver tailored, cost-effective coverage that protects your projects, your business, and your peace of mind—so you can focus on building what’s next.

Tyler Cook

Managing Director

Rachel Hammond

Director of Client Success

Janae Spinney

COO, StruCalc

Get A Custom Quote Today

Don’t pay more for generic insurance coverage that doesn’t fit your business.

If you’re the kind of person who likes to get things done quick, here’s a couple ways to get a fast quote.

Get a callback from our AEC insurance experts to determine the best coverage for your business.

By submitting this form, you agree to the Strux Insurance Privacy Policy.

Please select the state that your HQ is located in (you can add other locations later).

By submitting this form, you agree to the Strux Insurance Privacy Policy.