Insurance for Engineers

AREAS OF LIABILITY FOR ENGINEERS

Engineers are responsible for the safety, functionality, and integrity of the systems they design. Whether working in civil, structural, mechanical, or electrical disciplines, engineers face a wide variety of liability risks

Design Errors

Miscalculations or flaws in analysis can result in project failure or costly remediation.

Omissions in Plans or Specs

Missing information can cause delays, disputes, or construction rework.

Professional Negligence

Even unfounded allegations can result in expensive legal defense.

Code Violations or Noncompliance

Mistakes related to building codes or engineering standards can lead to regulatory fines or legal exposure.

Project Delays Tied to Engineering Scope

If your work causes delays or budget overruns, you could be held liable.

Coordination with Other Professionals

Conflicts with architects, contractors, or subcontractors can lead to shared liability or cross-claims.

The Challenge of Finding the Right

Insurance for Engineering FIRMS

Many insurance providers lump engineers into generic commercial categories, treating your firm like any other small business. But the truth is, the risks engineers face are anything but typical. Generic policies often:

- Overlook key professional exposures

- Offer irrelevant coverage that inflates premiums

- Exclude protection for claims tied to design work

And when a claim occurs, these providers often lack the industry-specific understanding needed to navigate engineering-related liability.

That’s why we built Strux Insurance: to offer cost-effective, industry-specific protection designed to get our customers the right coverage, so they can keep doing what they do best.

How Strux Is Different

Strux Insurance was founded by engineering and construction professionals who understand the industry and the risks. We’re not just brokers. We’re industry professionals who have practical experience in the construction industry and need the same kind of insurance solutions that you do. Here’s what sets us apart:

Niche Expertise

We work exclusively with firms in the architecture, engineering, and construction space.

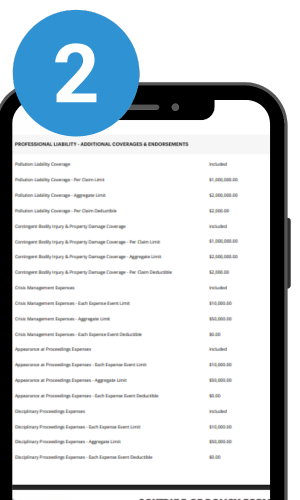

Specialized Carriers

We’ve built relationships with top-tier insurance providers who specialize in coverage for design professionals.

Exclusive Pricing

Our partner carriers give us access to preferred rates and specialized policy options you won’t find elsewhere.

Licensed Nationwide

We’re licensed in over 45 states, so no matter where your firm operates, we can help.

How to Determine Which Insurance Plan

Is Right for Your Business

Choosing the right insurance plan starts with understanding the fundamentals of coverage:

what it protects, how much protection you need, and what it will cost.

1. What Does It Cover?

Start by identifying your firm’s specific exposures:

- Does your work involve high-risk structures or specialty designs?

- Do you handle permitting, code compliance, or client-facing documentation?

- Do you have employees or subcontractors who visit active job sites?

The right plan should protect you against both physical risks (covered by general liability) and professional risks (covered by E&O insurance).

2. How Much Coverage Do You Need?

Coverage limits depend on the size and complexity of your projects:

- Small firms may need $500k–$1M in coverage

- Mid-size firms often need $1M–$3M

- High-value projects may justify limits of $5M or more

Look for policies that scale with your growth and allow for flexible endorsements.

3. What Will It Cost?

Insurance premiums are based on multiple factors:

- Revenue and project volume

- Claims history

- Project types (residential vs. commercial)

- Geographic location

- Desired limits and deductibles

At Strux, we analyze these variables and match your firm with carriers that understand your risk profile, so that you get the best coverage for the lowest cost.

4. How Easy Is It to Update or File a Claim?

Consider how responsive your provider is and whether they understand the work you do, so that when you need them, they will be able to act quickly and get you the support you need.

Get the Right Coverage for Your Practice

Engineers face enough pressure in their everyday work. You shouldn’t have to worry about whether your insurance will hold up if something goes wrong.

Strux Insurance helps engineers across the U.S. get the coverage they need to keep doing what they do best.

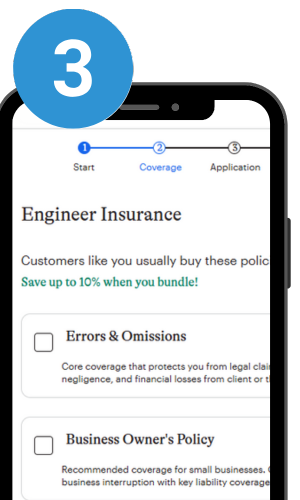

Answer Some Questions About Your Business and Projects

Get An Instant Quote Tailored To Your Business

Choose The Best Plan and Sign Up Online

Prefer a call?

If you’d like a custom quote from one of our agents, reach out to us at

945-293-3922.

Prefer a call? If you’d like a custom quote from one of our agents, reach out to us at 945-293-3922.

The Strux Insurance Team

Our company was founded by engineering and construction veterans, who understand the challenges of getting the right coverage and built solutions to serve the engineering, architecture and construction communities. We’re more than an insurance provider we’re industry veterans who understand the real risks behind every drawing and project. We created Strux to fill the gap between generic insurance offerings and the specialized needs of architects, engineers, builders, and general contractors. Our mission is to deliver tailored, cost-effective coverage that protects your projects, your business, and your peace of mind so you can focus on building what’s next.

Tyler Cook

Managing Director

Rachel Hammond

Director of Client Success

Janae Spinney

COO, StruCalc

If you’re the kind of person who likes to get things done quick, here’s a couple ways to get a fast quote.

Get a callback from our AEC insurance experts to determine the best coverage for your business.

By submitting this form, you agree to the Strux Insurance Privacy Policy.

Please select the state that your HQ is located in (you can add other locations later).

By submitting this form, you agree to the Strux Insurance Privacy Policy.

Get A Custom Quote Today

Don’t pay more for generic insurance coverage that doesn’t fit your business.